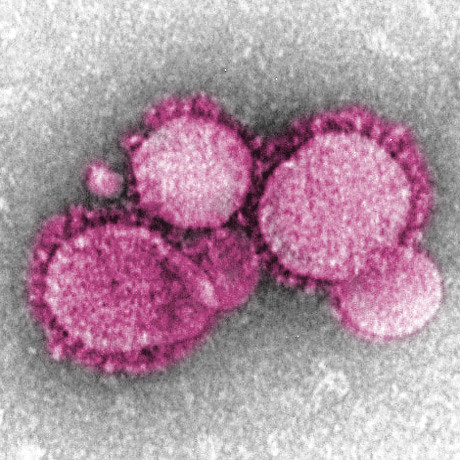

As the coronavirus pandemic continues to worsen, the global economy appears to be on the brink of collapse.

Stock prices, once at record highs, have crashed over the past few months. Since social distancing orders began, a record-breaking 17 million Americans had applied for unemployment benefits due to the crisis. On March 27, Kristalina Georgieva, the managing director of the IMF, stated that the global economy had entered a major recession on par with or worse than the Great Recession that occurred more than a decade ago.

In a matter of months, the coronavirus outbreak has decimated one of the strongest economic recoveries in recent times. With the world left scrambling to deal with the disastrous ramifications of the downturn, many are wondering how it happened.

The global economic crisis began in early March after negotiations between the OPEC nations, led by Saudi Arabia, and Russia over proposed cuts to oil production. Falling global demand for oil, especially in China, due to the coronavirus outbreak prompted an OPEC meeting where the decision was made to reduce oil production by 1.5 million barrels per day during the second quarter of 2020.

The Russian government refused to adhere to the OPEC decision. In response, Saudi Arabia began selling its oil at hugely discounted prices on March 8.

According to reports from Al Jazeera, the Russian government was attempting to damage US shale producers in response to recent US sanctions imposed on Rosneft Trading, a subsidiary of the state-controlled oil company, for supporting Venezuelan leader Nicolás Maduro. Many US oil producers use shale oil extraction, typically more expensive than other methods of oil production, which is reliant on high oil prices globally to compete with other producers.

On Monday, oil prices dropped more than 20 percent. Stock prices collapsed so dramatically that trading was temporarily halted. The Dow Jones Industrial Average (DJI) dropped nearly 2000 points while the S&P 500 dropped nearly 8 percent.

On March 12, stock prices dropped even further in response to President Trump’s announcement of a month-long European travel ban during an oval office address the previous night.

In the span of 4 days, US stock prices had their largest drop since the stock market crash in 1987.

The coronavirus pandemic is so devastating because it creates demand and supply shocks in the global economy. A shock is an increase or decrease in the aggregate supply or demand of a nation’s economy. COVID-19 causes a decrease in the supply of goods and services as workers can no longer go to manufacture goods except for essential businesses.

At the same time, consumers are demanding less goods, with some sectors being more affected than others.

Many travel companies are in turmoil due to the pandemic. All major American cruise businesses have temporarily ceased operations. Among these companies is Princess Cruises, which operated several cruise ships that suffered large coronavirus outbreaks.

Several airlines have substantially reduced their airfares to offset heavy drops in demand. While commercial aircraft continue to fly despite the outbreak, they have very few passengers and air routes beyond the US.

WIS has canceled or postponed several trips as a result of the coronavirus pandemic, including the 10th grade trip to New Orleans, the 8th-grade language trips and the trip to China.

The service sector, the largest part of the US economy, has also taken a toll as a result of the COVID-19 outbreak. While certain essential businesses continue to operate, many others are closing permanently or temporarily and laying off workers. Unemployment claims have spiked to a historic high of nearly 17 million in less than a month.

In response to the economic crisis, the US has implemented several policies to help protect the economy. The Federal Reserve has lowered interest rates to close to zero to encourage spending, even when interest rates had been close to their lowest point in history before the viral outbreak.

On March 27, President Trump signed the $2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act into law. The act expands unemployment benefits and gives checks of up to $1,200 for individuals and up to $2,400 for families up to a certain income threshold.

The act also controversially provides about $500 billion in loans to US businesses.

The coronavirus outbreak has caused significant damage to the global economy, primarily as a result of stay at home orders and consumer caution. While checks to workers and lowered interest rates help encourage compliance with health initiatives, significant economic measures to restart the economy will not be implemented for a long time.

A focus on public health and safety, however, is critical to any form of economic recovery after the pandemic.

By Nicolas Greamo